Case Study

How a U.S. Bank used Cape to automate Enhanced Due Diligence from 2 hours to 90 seconds.

When the Chief Compliance Officer of a prominent U.S. bank started exploring Cape, they had one main goal in mind:

Streamline and automate their time-consuming Enhanced Due Diligence (EDD) process for high-risk customers.

However, during a demo with one of Cape's experts, they discovered that Cape could offer much more than they initially expected.

“At first, I thought Cape could only handle basic automation. During the demo, when I saw the full capabilities, I was blown away.”…”Cape addressed a much broader range of compliance issues than I had anticipated.”

The problem Cape solves has been a longstanding issue in the banking industry:

“Cape tackled one of the most significant challenges in compliance over the past decade… Before Cape, our EDD process was labor-intensive and inefficient, requiring hours of manual effort for each report.”

We hear this from many of our clients—they need a solution that automates, integrates, and enhances their compliance processes. Cape does precisely that.

Once the bank’s Chief Compliance Officer realized the potential of Cape, they immediately set out to transform their EDD workflow. Here’s how they did it:

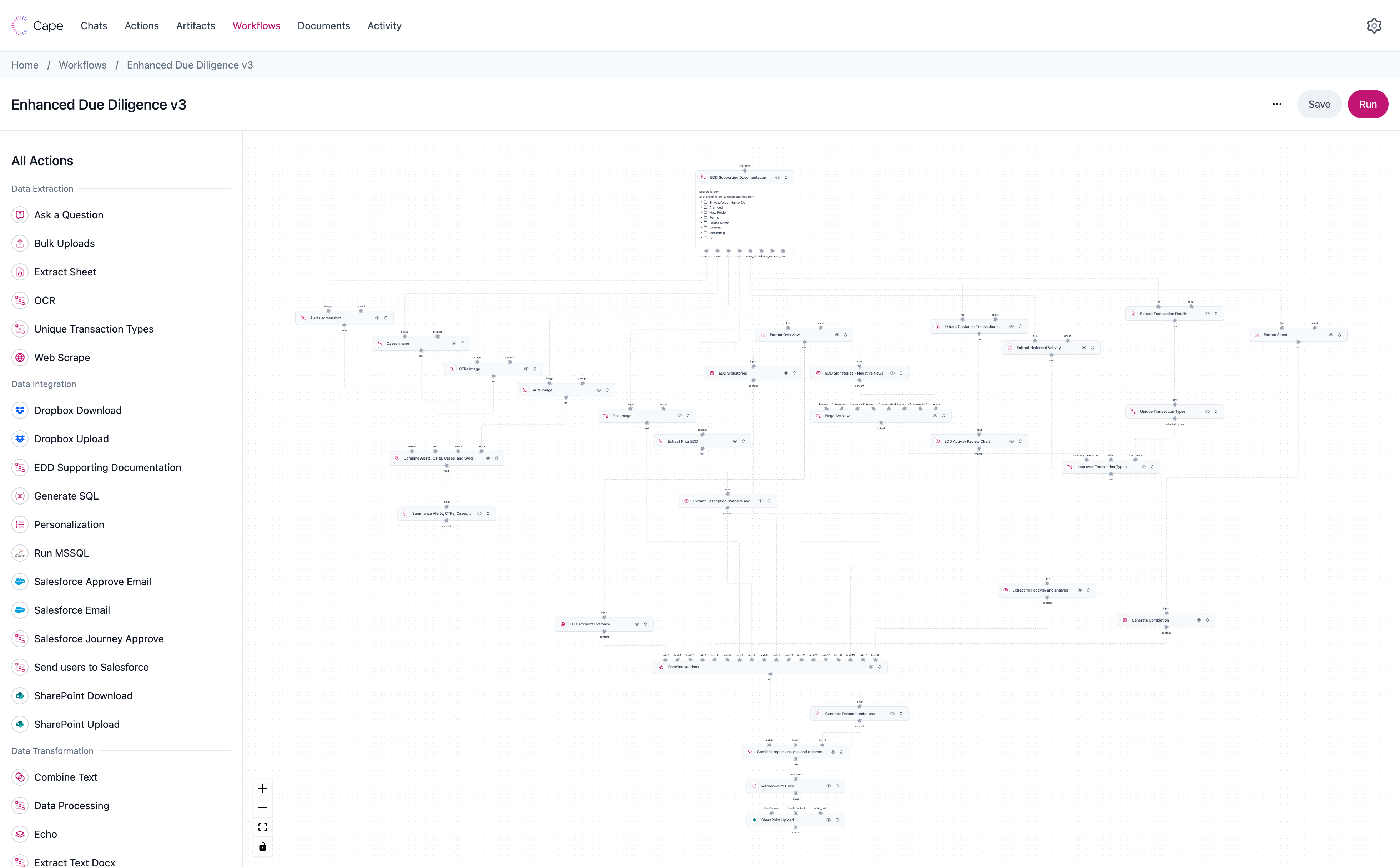

First, they integrated Cape with their existing systems, which included Abrigo BAM+ for alerts and case management, Power BI for transaction analysis, and SharePoint for document management.

Next, they used Cape to automate the entire process, starting from data collection and ending with the final EDD report. The integration preserved the bank’s investment in their current systems while significantly enhancing efficiency and accuracy.

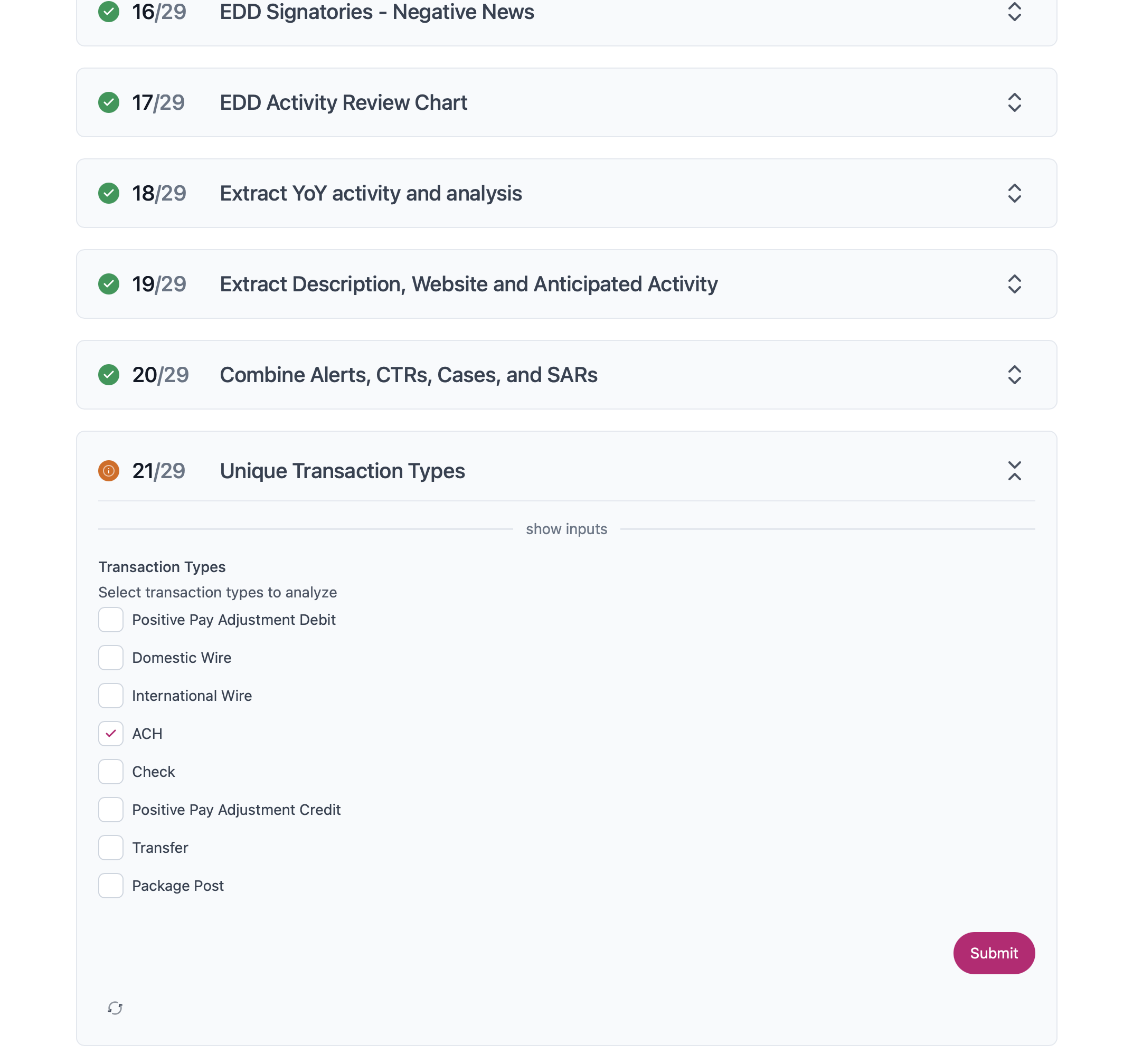

After that, they customized the EDD workflows using Cape’s flexible workflow builder. They were able to input and refine reports according to their specific requirements and internal policies using natural language processing.

Then, Cape automated the generation and management of alerts, data aggregation from Power BI, documentation through SharePoint, and report writing in Microsoft Word. Each step was audit-tracked for compliance and transparency.

“The whole process transformation took us from hours of manual work to just 90 seconds per EDD report.”

The results? We’ll let the Chief Compliance Officer tell you:

“The improvement was immediate. We reduced the time for each EDD report from hours to just 90 seconds. Analysts could now focus on quality assurance and higher-level analysis instead of manual tasks. Within the first week, we saw enhanced efficiency and compliance. We were able to scale our compliance measures effortlessly and capture every step for transparent audit trails.”

They attribute Cape to helping them not only streamline their EDD process but also significantly improve compliance and operational efficiency. In their opinion, automated and integrated processes are the future of banking compliance.

“Your compliance workflow is your strategy. The effort you put into automating and refining it will directly translate to reduced risk and increased efficiency.”

Want to learn more about Cape? Contact us today to transform your bank's EDD process with our innovative solutions.