Solution

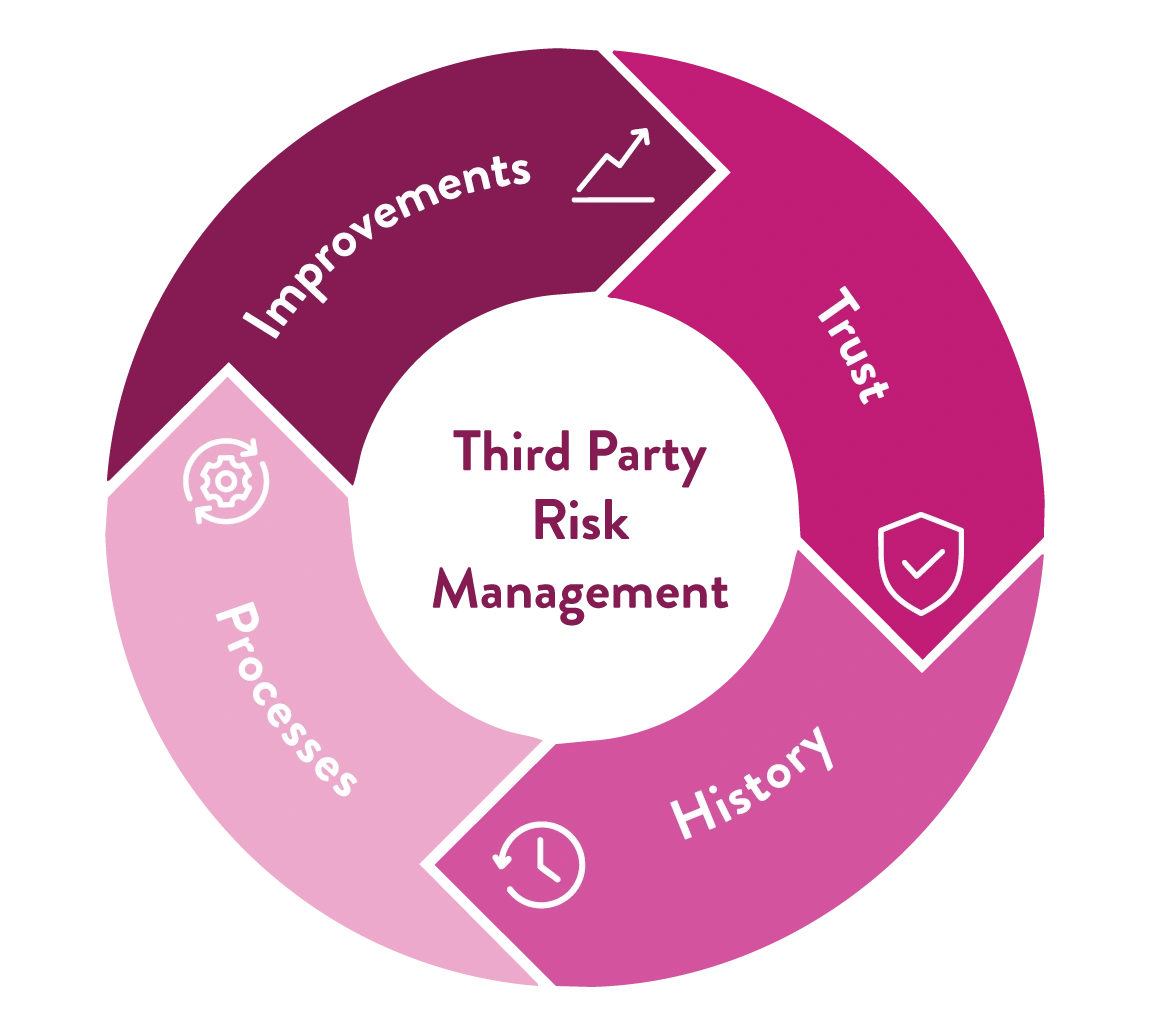

Defining the Future of Third Party Risk Management

Improve control, increase efficiency, and instill confidence in your operations.

Regulated industries and specifically Financial Services organizations worldwide face third-party risk management complexities every day. What if AI could revolutionize this process, amplifying the precision and speed of risk management operations? At Cape, we've turned this innovative vision into reality.

Today, third-party risk management poses several significant challenges to organizations.

Manually Intensive: Traditional methods of risk management involve manual data collection, processing, and monitoring. Not only do these tasks consume valuable man-hours, but they also expose organizations to the risk of manual errors, compromising the integrity of the risk profile.

Time-Consuming: Analyzing and reviewing complex SOC reports, ensuring ongoing compliance with regulatory standards, and identifying potential risks is a time-consuming process. Often, this process must be repeated multiple times for each party, contributing further to the overall operational inefficiency.

Redundant Processing: Each external party that an organization deals with necessitates a separate analysis process, leading to repetitive, redundant work. The repetition scale only increases with the number of third parties involved, creating incessant cycles of duplicate work that significantly slow down operations and drain resources.

The AI-Powered Solution:

Cape's solution effectively counters these challenges by leveraging the power of artificial intelligence, fundamentally transforming how organizations manage third-party risks.

AI-Augmented Reporting: Ditch the laborious task of sifting through complex SOC reports. Our advanced AI undertakes an exhaustive review of these reports, identifies patterns, inconsistencies, and potential risks, subsequently distilling this information into clear, digestible summaries. This dramatically cuts down time spent on report analysis.

Enhanced Integration: Instead of overhauling your current systems, our solution amplifies them. Cape integrates smoothly with your existing reporting and control processes, adding an AI layer that augments your established mechanisms.

Automated Compliance Management: With our AI solution, compliance becomes an effortless exercise rather than a cumbersome afterthought. Cape identifies vital elements in your operations and monitors their changes, maintaining constant compliance with regulatory standards. Plus, you'll be alerted in real-time for areas needing immediate attention, simplifying compliance management.

Streamlined Processes: Our solution is particularly beneficial for manually intensive and redundant procedures. Cape automates these tasks, freeing up your team's time for more strategic work, reducing errors, and improving overall productivity.

With Cape, organizations can expect a sea change in their third-party risk management, moving from a laborious, manual process to a streamlined, automated one. Step up with Cape into the future of effective and efficient risk management.